Crypto markets often move on positioning before the price reacts. In the final days of January, attention is shifting toward a small group of ‘made in USA coins’ that are no longer trending with the broader market, but are instead showing early signs of major shifts, both bullish and bearish.

As the market looks for direction heading into February, these three made in USA coins stand out based on price structure, on-chain positioning, momentum signals, and accumulation patterns.

Chainlink (LINK)

One of the first made in the USA coins to watch this week is Chainlink. LINK price has struggled recently, falling around 7.5% over the past seven days and roughly 3.6% over the past 30 days. On the surface, the trend still looks weak, but underlying signals are starting to shift.

From an on-chain perspective, Chainlink is trading at a relatively low 30-day MVRV level. MVRV compares the average holder’s cost basis with the current price.

When it turns negative, it suggests many traders are sitting on losses, which historically reduces sell pressure and lowers downside risk. In simple terms, LINK is no longer crowded with short-term profit takers.

The chart adds to this picture. Between late November and January 25, Chainlink’s price printed a lower low, while the Relative Strength Index (RSI) formed a higher low.

RSI measures momentum, and this mismatch is known as a bullish divergence. It often appears when downside momentum weakens, even if the price has not reversed yet.

For this setup to strengthen, Chainlink needs to reclaim $12.51, a level that has repeatedly acted as both support and resistance.

A daily close above it would signal the rebound is gaining traction. Above that, $14.39 becomes the zone that flips the broader structure bullish, opening the path toward $15.01.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

If the price instead loses $11.35 on a daily close, the bullish case weakens, and the recovery thesis would need to wait. Until then, LINK remains one of the more technically interesting made in USA coins heading into February.

World Liberty Financial (WLFI)

World Liberty Financial is another made in USA coin drawing attention this week, but for very different reasons. While the WLFI token is up about 12% over the past 30 days, on-chain positioning shows a sharp split between large holders and faster-moving capital.

Over the same period, whales have reduced their WLFI holdings by more than 75%, while smart money wallets have increased exposure by roughly 95%.

Smart money typically represents more active, short-term traders, while whales often signal longer-term conviction. When these two groups diverge this sharply, it usually points to instability rather than a clean trend.

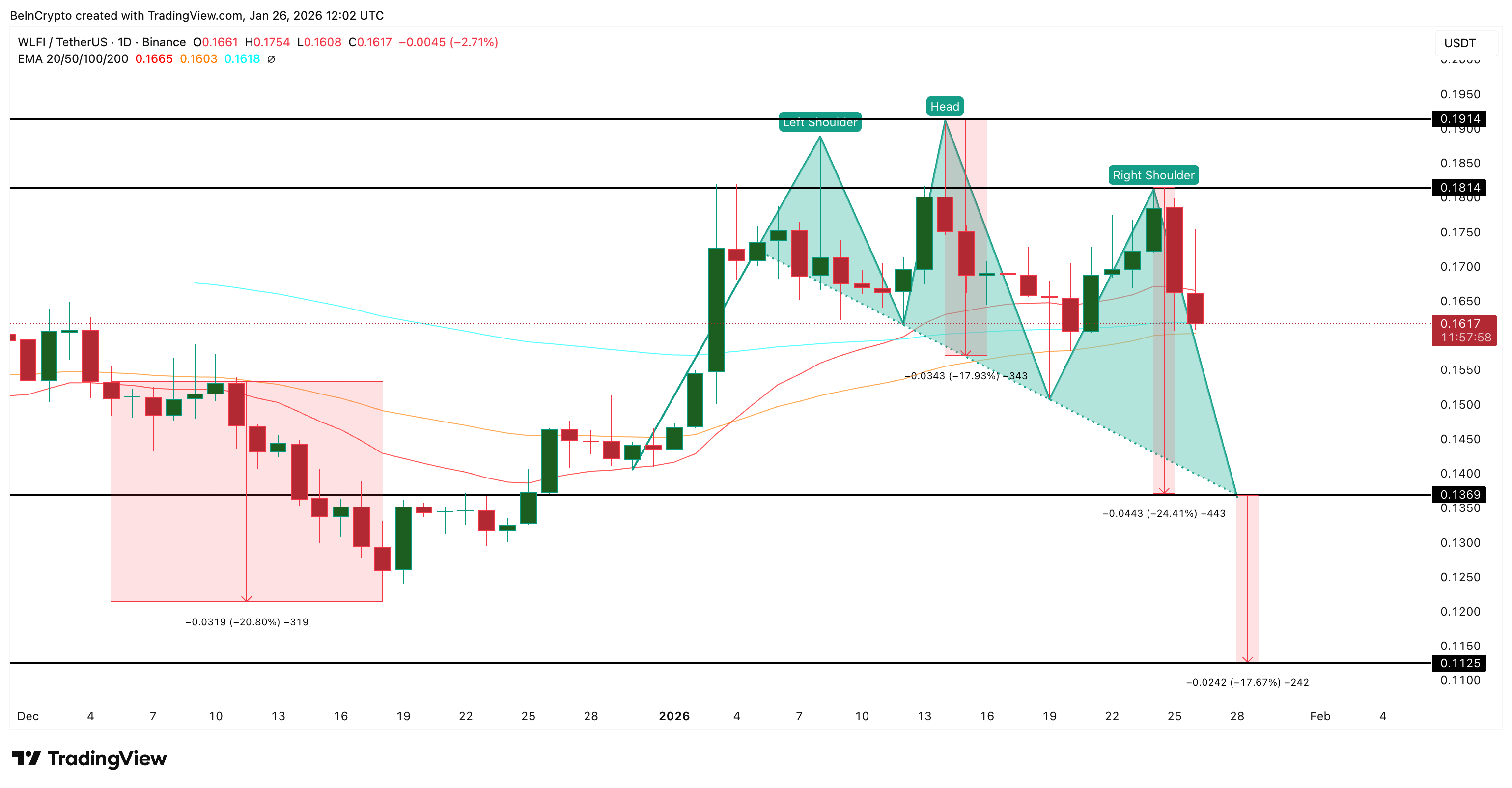

The chart reflects that tension. WLFI is forming a head-and-shoulders pattern on the daily timeframe, but with a steep, downward-sloping neckline, favoring the sellers. This type of structure signals growing downside risk if support fails.

The token has also recently lost its 20-day EMA (exponential moving average) line, and is now at risk of testing the 50-day EMA line. The last time both were lost together, the price corrected close to 20%.

The EMA gives more weight to recent prices, so it reacts faster to trend changes. These lines can act as critical support/resistance zones.

If WLFI slips below the 50-EMA and then $0.136, the pattern strengthens to the downside, opening the door for a deeper pullback toward $0.112.

On the flip side, reclaiming $0.181 would restore some confidence in the smart money thesis. A move above $0.191 would invalidate the bearish structure entirely.

This conflict makes WLFI one of the most volatile coins to watch in the last week of January. It may still bounce, but conviction remains split, and price could swing sharply in either direction.

Render (RENDER)

Render rounds out this list of made in USA coins with a setup driven more by flows than sentiment. Despite being up by over 50% over the past 30 days, the token has corrected roughly 4% over the past 24 hours, leading some traders to question whether the rally is losing steam.

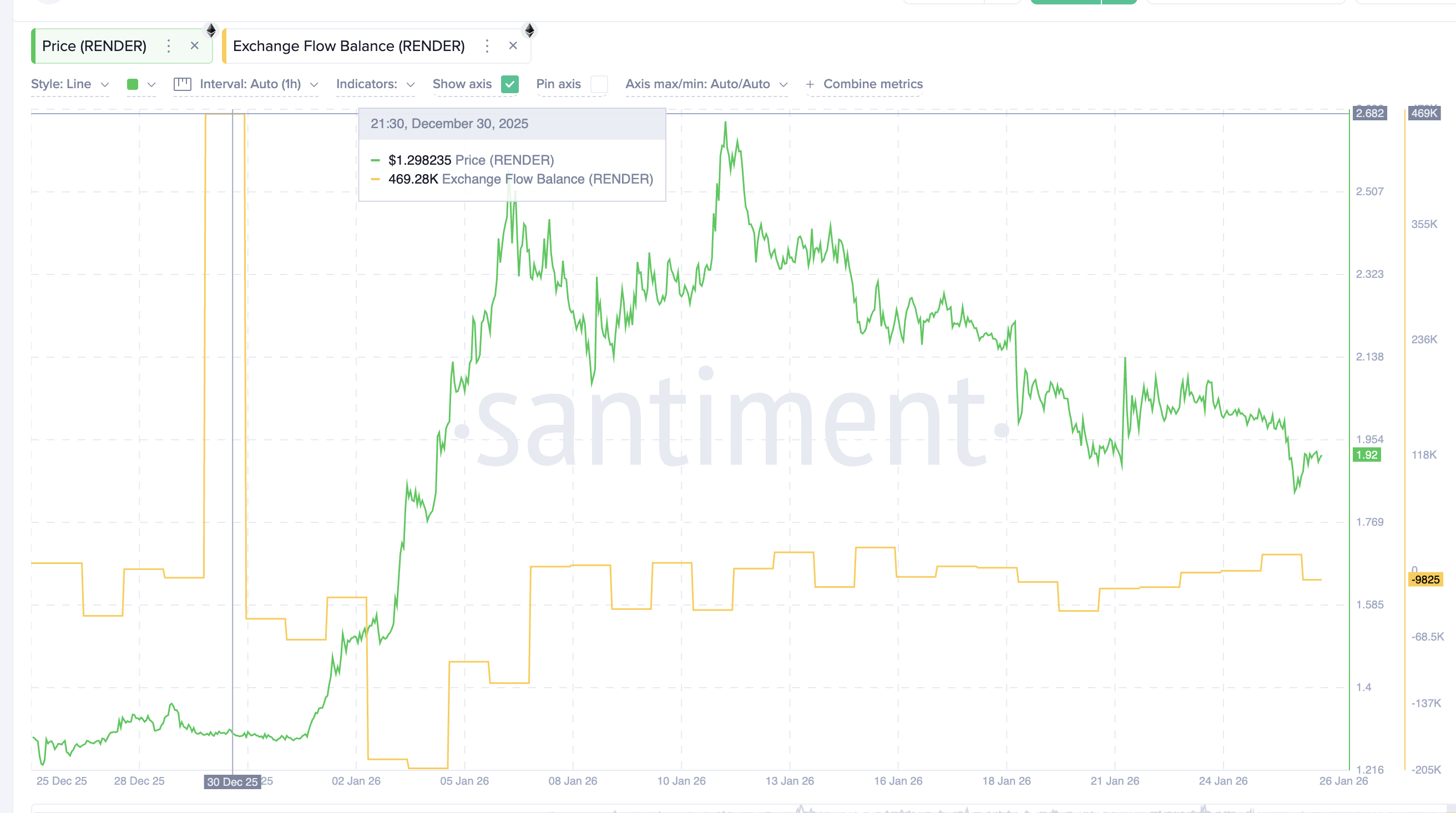

Exchange flow data suggests otherwise. In late December, Render saw heavy inflows into exchanges, signaling strong selling pressure.

At its peak, net inflows reached roughly 469,000 tokens. As of January 26, that figure has flipped to a net outflow of around 9,800 tokens. This shift shows that selling pressure has largely dried up, and accumulation may be starting instead.

On the chart, RENDER is consolidating within a falling channel after a sharp 130% rally from December 19 to January 11. While the channel remains intact, price is now pressing against its upper boundary. A move above $2.03 would break the channel and turn the structure neutral to bullish.

If that breakout occurs, upside targets near $2.37 and $2.71 come into view. Failure to reclaim the channel keeps the token vulnerable in the short term, with $1.88 serving as the first line of defense.

A deeper breakdown only becomes likely below $1.49, which remains far from the current price.

With AI narratives still active and selling pressure easing, Render stands out as one of the more structurally balanced made in USA coins to watch in the last week of January.

The post 3 Made In USA Coins to Watch in the Last Week of January appeared first on BeInCrypto.