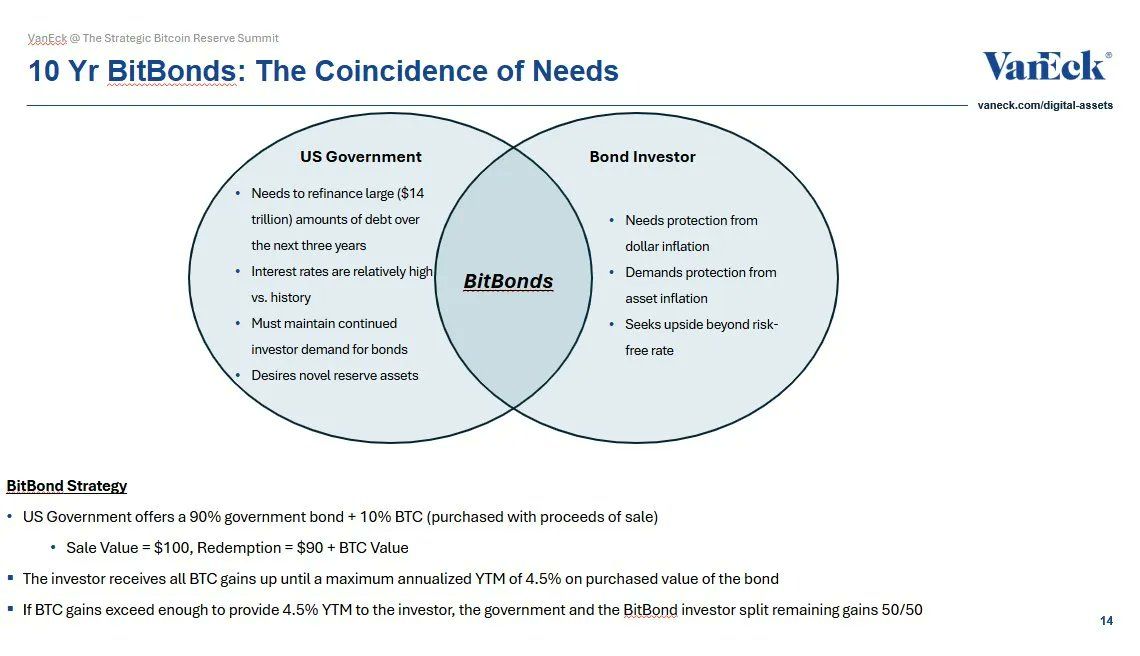

VanEck has proposed a new financial instrument called 'BitBonds' to help the U.S. refinance its $14 trillion national debt over the next three years. The proposal aims to provide investors with inflation protection by linking Treasury bonds to Bitcoin. The structure of BitBonds includes a 90% allocation to Treasury securities and a 10% allocation to Bitcoin, allowing for full Bitcoin upside until a 4.5% annual return is reached. After that threshold, the upside will be split 50/50 between Bitcoin and Treasury returns. This initiative is seen as a solution to align the interests of investors with the need for government financing.

This is an AI-generated article powered by DeepNewz, curated by The Defiant. For more information, including article sources, visit DeepNewz.

To continue reading this as well as other DeFi and Web3 news, visit us at thedefiant.io