Welcome to the US Morning Crypto Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee to see why Bitcoin’s path to recovery is under pressure, how $1 billion in liquidations rattled the market, what Jamie Dimon and Max Keiser are saying about tariffs, and where short-term holders now stand after the latest correction.

Macro Uncertainty and $1 Billion Liquidations Put Bitcoin’s Recovery to the Test

Amid heightened volatility in all markets, analysts remain divided on whether the latest Bitcoin sell-off signals a deeper downturn or a temporary shakeout.

Over the weekend, Bitcoin dropped sharply—mirroring broader uncertainty sparked by geopolitical tensions and Trump’s newly proposed tariffs. Yet, some experts believe a rebound is likely.

Geoff Kendrick of Standard Chartered told BeInCrypto that despite Sunday’s dip, Bitcoin is still performing relatively well, trailing only Microsoft and Google in returns over the same time frame.

“Sometimes crypto movements on Sunday tell you what stocks are going to do Monday. If that’s the case, Monday could be ugly. However, FX markets just opened, and the AUD is unchanged from Friday. If FX is right, then the crypto sell-off will be faded and BTC will likely head back to its Friday close of $84,000,” said Geoff Kendrick, the Global Head of Digital Assets Research at Standard Chartered

Kendrick believes tariff fears may be overstated and that Bitcoin could emerge as a hedge against growing US isolationism and fiat risk.

This view contrasts with comments from Trump’s top economic adviser, Kevin Hassett, who tried to calm markets by stating that 50 countries have reached out to negotiate tariffs and that the impact on consumers would be minimal.

Still, crypto analyst and Coin Bureau founder Nic Puckrin warns that while a V-shaped recovery is possible—especially given over $1 billion in liquidations—it may be short-lived.

“There’s a real risk of a dead cat bounce. Macro is in the driver’s seat, and it’s extremely unpredictable right now,” Nic Puckrin told BeInCrypto, urging caution for new investors jumping in too early.

The path ahead remains murky, but both analysts agree that macro conditions will be the key force shaping crypto’s future.

Dimon, Tariffs, and the Case for Bitcoin as a Hedge

Adding to the caution, JPMorgan Chase CEO Jamie Dimon issued a stark warning in his annual letter to shareholders, highlighting deeper structural risks facing the global economy.

“There also remains a growing need for increased expenditure on infrastructure, the restructuring of global supply chains and the military, which may lead to stickier inflation and ultimately higher rates than markets currently expect,” Dimon wrote.

He also addressed the impact of recent US trade policy shifts, stating, “The recent tariffs will likely increase inflation and are causing many to consider a greater probability of a recession.”

Bitcoin Pioneer Max Keiser defends that the tariffs will enhance Bitcoin’s appeal as a hedge: “Everything that can be liquidated and moved into Bitcoin will be. It is outperforming everything else as global markers crash and is becoming the least risky asset ever,” Keiser told BeInCrypto.

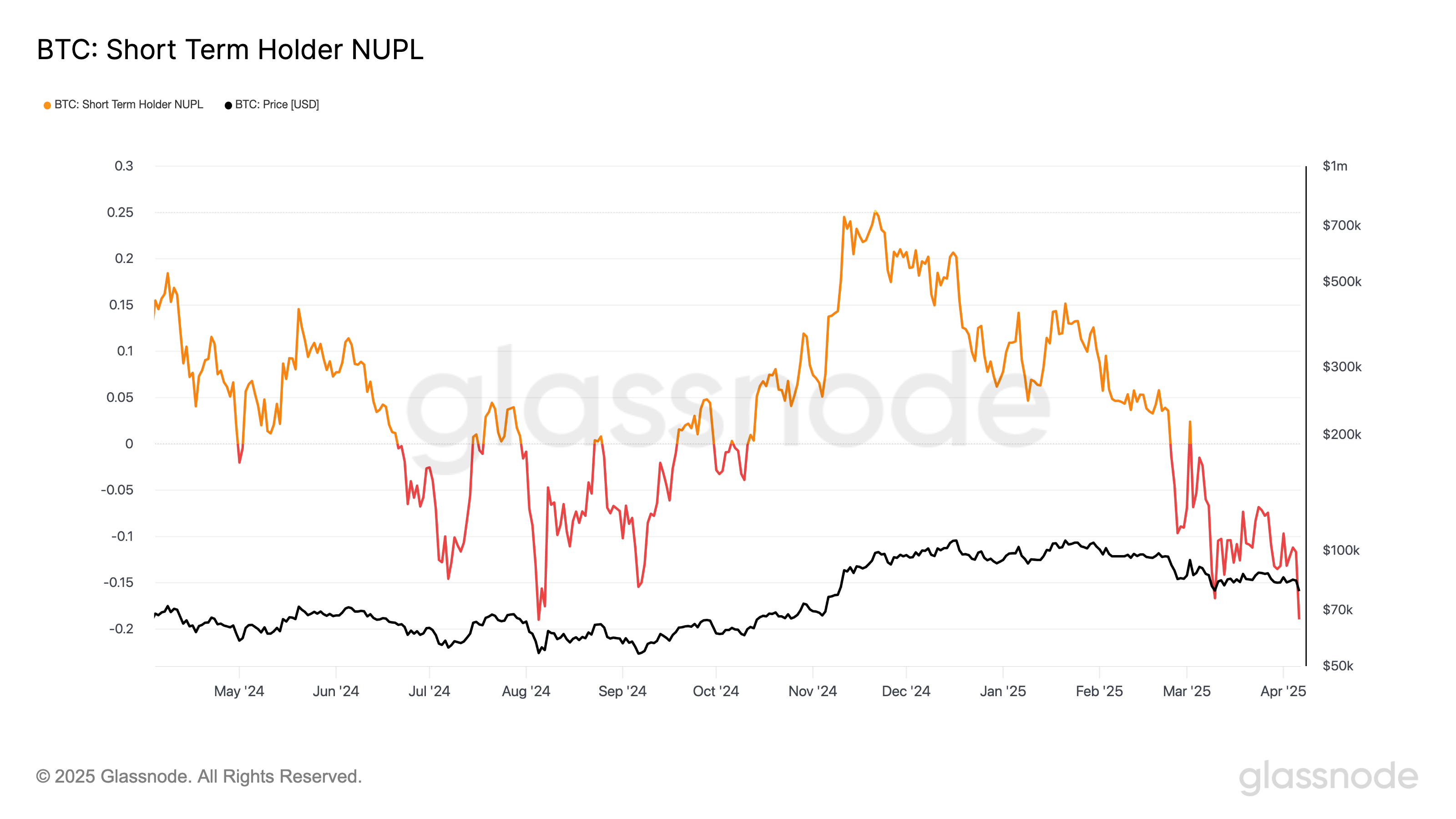

Crypto Chart of the Day

With the recent correction, BTC Short-Term Holders NUPL (Net Unrealized Profit/Loss) reached its lowest level since August 2024.

Byte-Sized Alpha

– The SEC has launched a broad review of its crypto policies under Trump’s directive, potentially reshaping how digital assets are classified under the Howey Test.

– Key US economic events—like FOMC minutes, CPI, and jobless claims—could swing Bitcoin’s price this week, with inflation data and Fed signals set to shape market sentiment.

– Analysts see parallels to the 2020 crash and predict the recent crypto dip. This is marked by Bitcoin falling below $80,000—could be a generational buying opportunity.

– Solana (SOL) plunged below $100 to a 14-month low amid market fears, but strong investor support and key indicators hint at a possible short-term rebound.

– Bitcoin fell below $75,000 with a 7% drop and declining futures interest, but bullish sentiment lingers as long-term holders maintain confidence.

– Crypto’s “Black Monday” saw $1 billion liquidated over the weekend, triggering a 10% market cap drop led by XRP and Ethereum. However, analysts still see the potential for a short-term rebound.

– Justin Sun alleges First Digital Trust’s misconduct with FDUSD is worse than FTX’s collapse, accusing it of asset theft without consent and offering a $50M bounty to aid investigations.

The post Standard Chartered Sees Bitcoin Rebounding by Friday | US Morning Crypto Briefing appeared first on BeInCrypto.