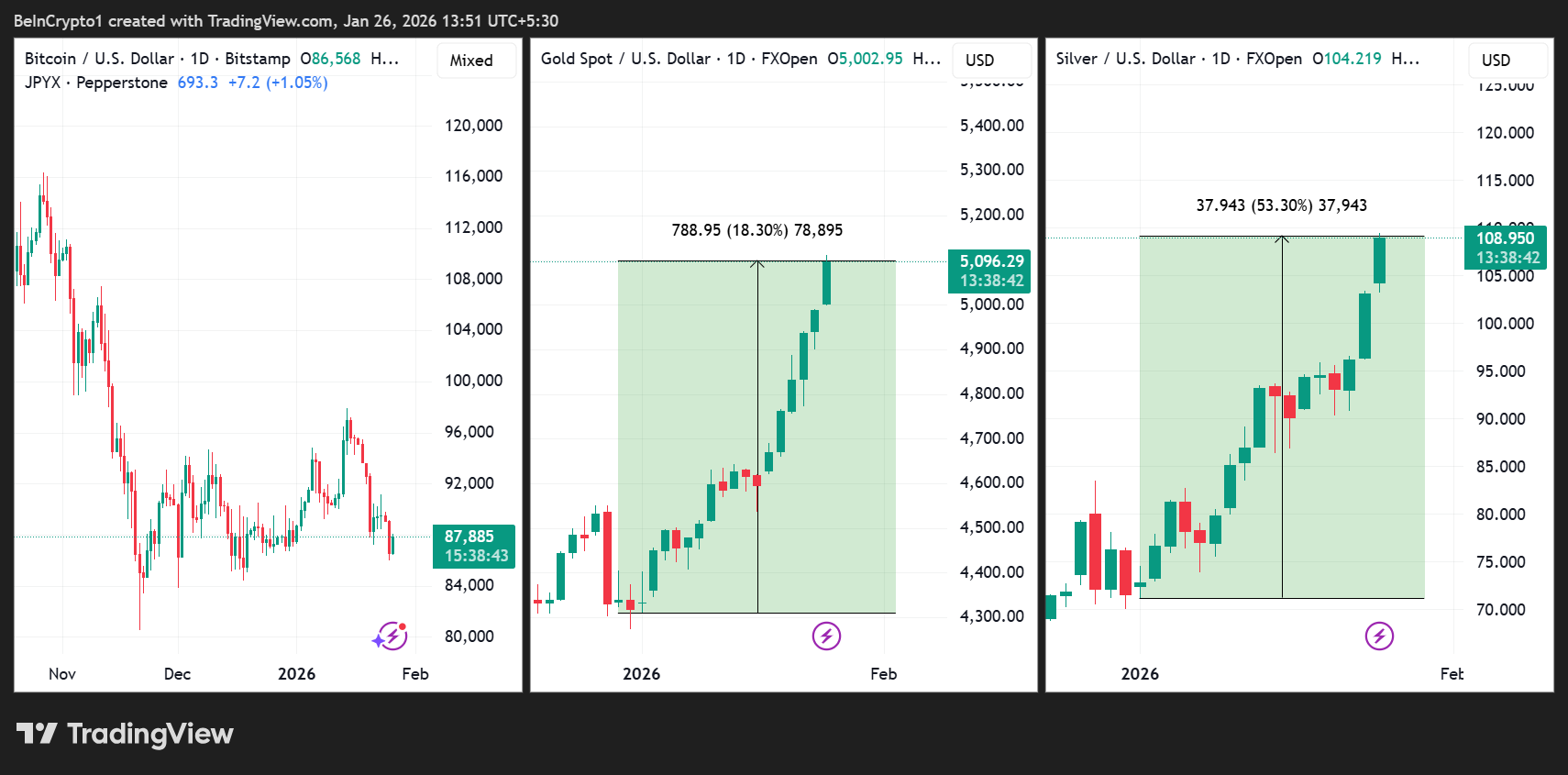

This week, investors in Bitcoin, gold, and silver are closely monitoring key US economic signals that could sway market sentiment and asset prices.

With Bitcoin hovering around $88,000, gold nearing $5,000 per ounce, and silver surpassing $100 per ounce amid ongoing safe-haven demand, these events carry significant implications.

4 US Economic Data Posts to Influence Investor Sentiment This Week

The Federal Reserve’s stance on interest rates remains pivotal. Lower rates typically boost risk assets like Bitcoin while reducing the opportunity cost of holding non-yielding assets like gold and silver.

Conversely, signs of economic strength or persistent inflation could pressure these assets by supporting higher rates.

Earnings from tech giants may also influence broader risk appetite, potentially spilling over into crypto and precious metals markets.

As global uncertainties persist and amid possible US government shutdown, the following indicators will shape short-term trajectories for these alternative investments.

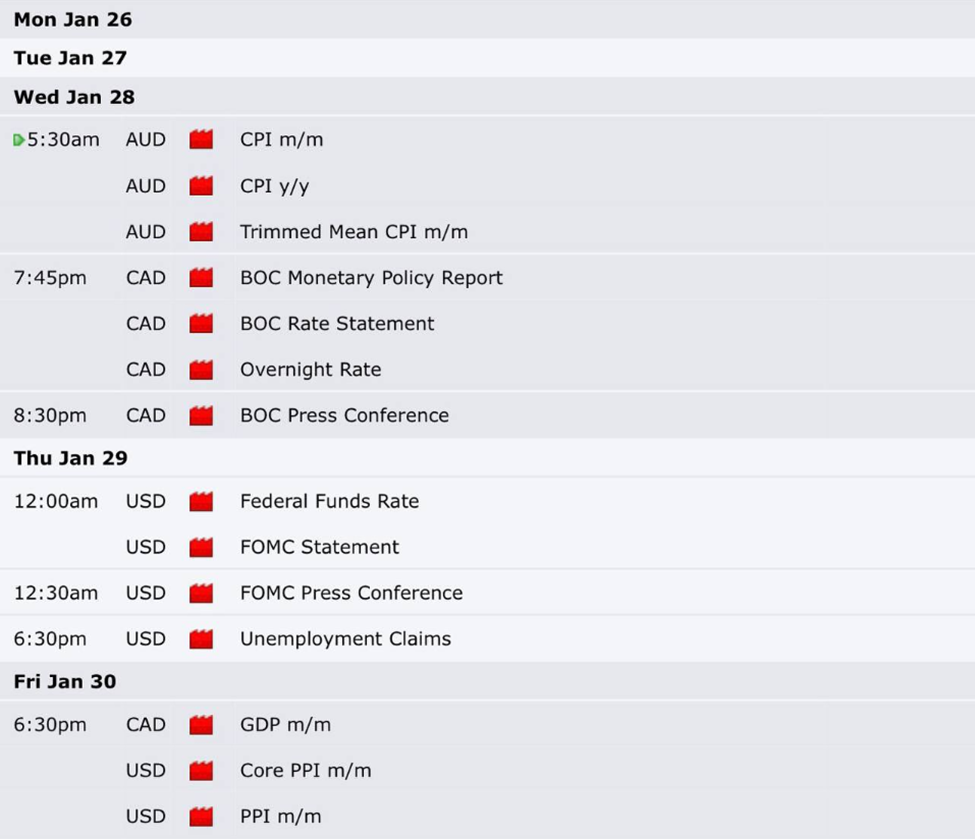

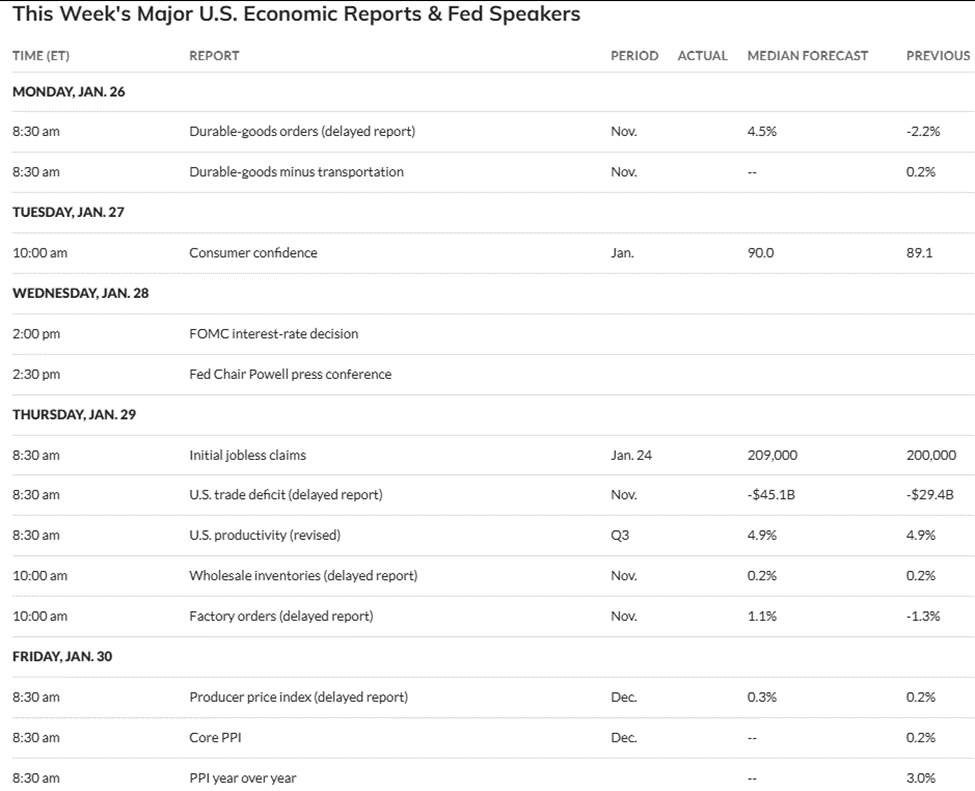

Fed Interest Rate Decision (FOMC) and Powell Press Conference

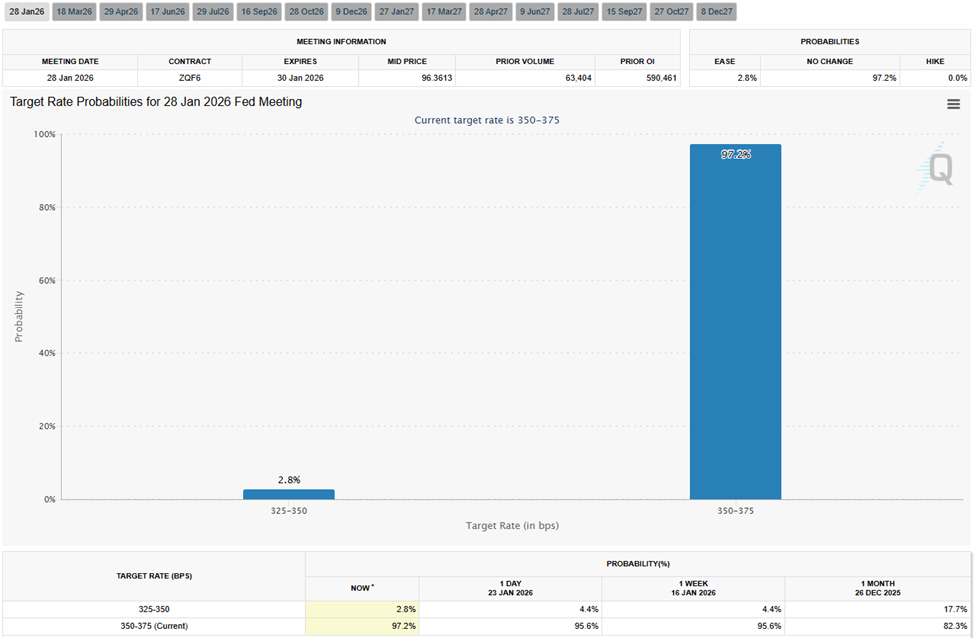

The Federal Open Market Committee’s (FOMC) interest rate decision on January 28, 2026, followed by Chair Jerome Powell’s press conference, is poised to be a major catalyst for Bitcoin, gold, and silver prices.

Current expectations overwhelmingly point to the Fed holding the federal funds rate steady at 3.50%-3.75%. All 100 economists in a recent Reuters poll anticipate no change, citing strong economic growth.

Against this backdrop, markets assign a 97.2% probability to this pause, as recent rate cuts in late 2025 have stabilized conditions.

JPMorgan forecasts the Fed will remain on hold through 2026, potentially hiking in 2027 if inflation reaccelerates.

For Bitcoin, a dovish pause, signaling future cuts, could fuel upside, as lower rates enhance risk appetite and liquidity. Historically, this has boosted crypto during easing cycles.

However, hawkish rhetoric from Powell on persistent inflation might trigger sell-offs, given Bitcoin’s sensitivity to monetary tightening.

“The market has fully priced in no rate cut… Why is this? – Low inflation – Better than expected GDP – Job numbers just mediocre. Pay attention to Powell’s speech and the guidance moving into 2026 instead,” commented analyst Mister Crypto.

Gold and silver, often viewed as inflation hedges, typically rise when rates fall, as reduced opportunity costs reduce their opportunity costs. A hold could stabilize them near records, but confirmation of no cuts might cap gains.

With gold up over 18% year-to-date to around $5,096 and silver surging 53% to $108, any hint of prolonged higher rates could pressure these metals by strengthening the dollar.

Powell’s comments on housing or growth will be scrutinized, as they could amplify volatility across these assets amid market-wide geopolitical tensions.

Initial Jobless Claims

Thursday’s release of initial jobless claims for the week ending January 24, 2026, will provide fresh insights into the health of the US labor market. This could directly influence sentiment around Bitcoin, gold, and silver.

Forecasts vary: RBC Economics predicts 195,000 claims, below the prior week’s 200,000, while market bets on platforms like Kalshi center on 210,000 or higher.

Recent data shows claims steady at 200,000 for the week ending January 17, signaling low layoffs and a resilient economy. The four-week average has dipped, reinforcing stability.

Lower-than-expected claims could bolster perceptions of economic strength, potentially delaying Fed rate cuts. This could pressure Bitcoin downward as higher rates curb risk-taking in crypto.

Conversely, a spike might signal softening, prompting dovish bets and lifting BTC prices, as seen in past instances where weak labor data fueled rallies.

For gold and silver, strong data might weigh on prices by supporting a hawkish Fed stance, increasing opportunity costs. However, if claims rise, these metals could gain as safe havens amid uncertainty.

With Bitcoin stalling while gold and silver soar, this report could exacerbate volatility, especially if it diverges from the median forecast of 209,000.

Such an outcome could amplify broader market reactions to Fed signals earlier in the week.

December PPI and Core PPI

Friday’s December 2025 Producer Price Index (PPI) and Core PPI data, released on January 30, 2026, will shed light on wholesale inflation trends. Ripple effects could spill over to Bitcoin, gold, and silver.

Forecasts indicate a 0.3% monthly rise in headline PPI, up from November’s 0.2%, while year-over-year could hit 3.0%. Core PPI is seen flat monthly but up 3.5% annually.

Recent November data showed a 3.0% yearly increase, with core at 2.9% in October. Analysts expect moderation, but surprises could alter Fed expectations.

Hotter-than-expected PPI might signal persistent inflation, strengthening the case for steady or higher rates. This could depress Bitcoin by reducing liquidity appeal for speculative assets.

Softer readings, however, could boost BTC by reinforcing easing bets, as seen in past soft data rallies. Gold and silver often benefit from inflation signals, acting as hedges. Therefore, elevated PPI could propel them higher, building on their gains so far.

Yet, if data suggests disinflation, prices might dip amid a stronger dollar. This release, following the FOMC and jobless claims, could drive weekly volatility, with PPI’s sensitivity to the business cycle making it a key barometer of these assets’ trajectories.

Various Earnings Reports (Microsoft, Meta, Tesla, Apple)

Tech giants Microsoft, Meta Platforms, and Tesla report earnings on Wednesday, January 28, 2026. Apple will follow on Thursday, January 29, amid heightened market focus on AI and growth prospects.

These “Magnificent 7” firms are expected to drive 2026 S&P earnings growth of 14.7%, with AI themes central to commentary.

Strong results could enhance risk sentiment, lifting Bitcoin as tech optimism spills into crypto, especially given BTC’s correlation with growth stocks during bull phases.

Weak beats or guidance might trigger sell-offs, pressuring BTC downward amid broader equity declines.

For gold and silver, strong earnings may foster risk-on environments, potentially diverting flows from safe havens and capping prices. Conversely, disappointments could boost them as hedges against uncertainty.

The post 4 US Economic Events to Influence Bitcoin, Gold, and Silver Prices This Week appeared first on BeInCrypto.